Take charge of your finances with budget apps

It’s pretty much impossible to watch the news or scroll through the headlines without seeing a report about inflation. Prices have been skyrocketing for months, and inflation is higher than it’s been since the early 1980s, according to research from the Pew Research Center. The Ukraine-Russia war and post-pandemic issues have caused the perfect storm, and you’re probably wondering what you can do about it. While it’s smart to learn how to save money on gas and groceries, you might need a more comprehensive plan for your finances—and that’s where the best budget apps can work some serious magic.

“Honestly, budgeting is difficult for many people,” says Sara Rathner, a personal finance expert at NerdWallet. “It takes work, and looking through your past spending can dig up a lot of guilt and shame. So any apps that take the sting out of budgeting can be hugely helpful.”

And let’s talk about just how helpful. According to one budgeting platform, new budgeters save an average of $600 in their first two months—and more than $6,000 in their first year! Still on the fence? Many of these apps are free, so you have nothing to lose and potentially a lot to gain. We rounded up the best budget apps for you, depending on your personal needs, preferences and spending style. Once you find the right one, check out the best gas apps and grocery shopping apps to save even more. Also, here are some amazing money-saving challenges you can start today to save up more.

Get Reader’s Digest’s Read Up newsletter for tips on tech, cleaning and travel, plus humor and fun facts, all week long.

Best for beginners

Mint

Mint is the most downloaded personal finance app, and it’s easy to see why people love it. It’s free and simple to use, and it can sync with several different bank accounts. “For those looking for a relatively simple way to set up a budget, it’s hard to go wrong with Mint,” says Julie Ramhold, a consumer analyst at DealNews.com. “It lets you get pretty granular with your budget, tracking expenses and allowing you to create unlimited categories.”

You can even set alerts for categories and spending, and this free budget app will let you know if you’re getting close to your limit. That can help you avoid overspending, Ramhold adds. To keep your expenses down, check out these things money experts tend to buy cheap.

Pros:

- Can track multiple accounts

- Wide range of categories and subcategories—from Food and Dining to Taxes

- Alerts you if you’re getting close to your limit

Cons:

- Can take time to set up

- Categories might glitch occasionally

Best for detail-oriented people

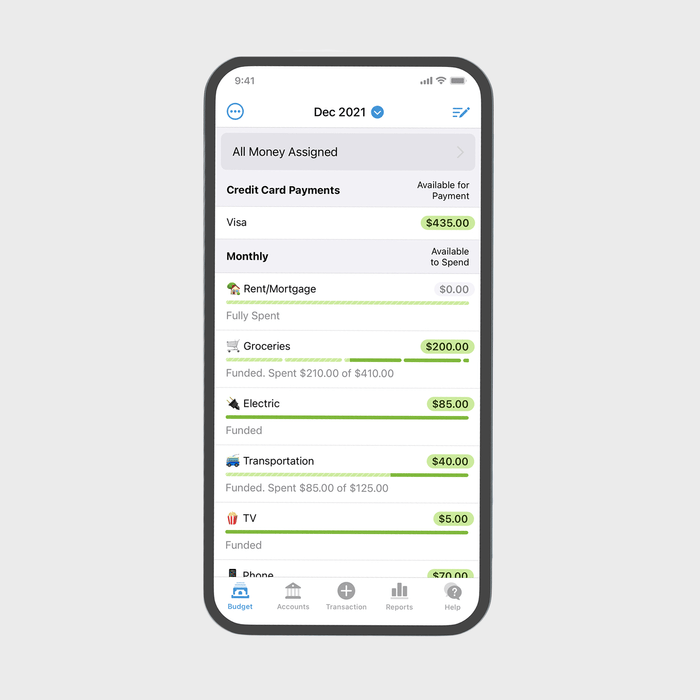

YNAB (You Need a Budget)

If you’re looking for a hands-on budget app, this is the one for you. “YNAB is good for anyone who wants to get into the type of budgeting that accounts for every single dollar,” says Ramhold. “Input your pay, and then YNAB provides advice on how much should go toward expenses and goals, including savings.” YNAB also emphasizes how budgeting can help you change your life by dealing with debt, which just may help you stick with it.

By the way, this is the budget app we alluded to earlier that saved users an average of $600 per month for their first two months and $6,000 in their first year. While it’s a paid program, you can test it out with a 34-day free trial—no credit card needed—to make sure it’s right for you.

Pros:

- Simple four-rule method

- College students can get a full year free

Cons:

- Not free after trial ($83.99/year)

- Needs frequent monitoring

Best for simple tracking

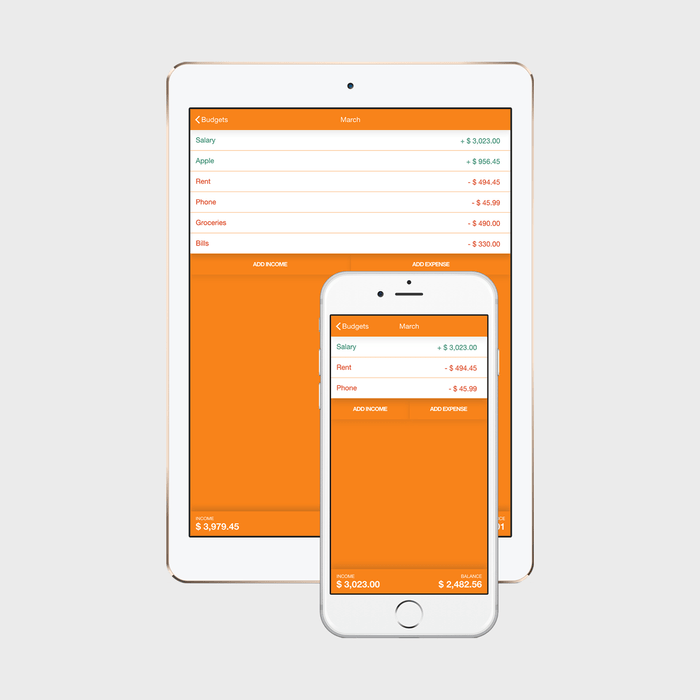

Fudget

Fudget is basically a step beyond a spreadsheet, says Rathner. “You manually input your income and spending, and categorize each item as you see fit.” It’s basically the opposite of a feature-rich, lots-of-bells-and-whistles app, with a simple, line-item approach to what’s coming in and what needs to go out.

One happy reviewer raves, “While other more complex apps and programs are too much to handle and eventually fall to the wayside, I can keep up with this thing—and it makes a big difference in my budget!” Shopping at the best grocery stores can also save you a bundle.

Pros:

- No complicated charts or learning curve

- Don’t have to link to your bank accounts if you don’t want to

Con:

- Certain features, such as the ability to export to a .csv file or choose your background color, require Pro upgrade ($3.99) on the mobile app

Best for traditionalists

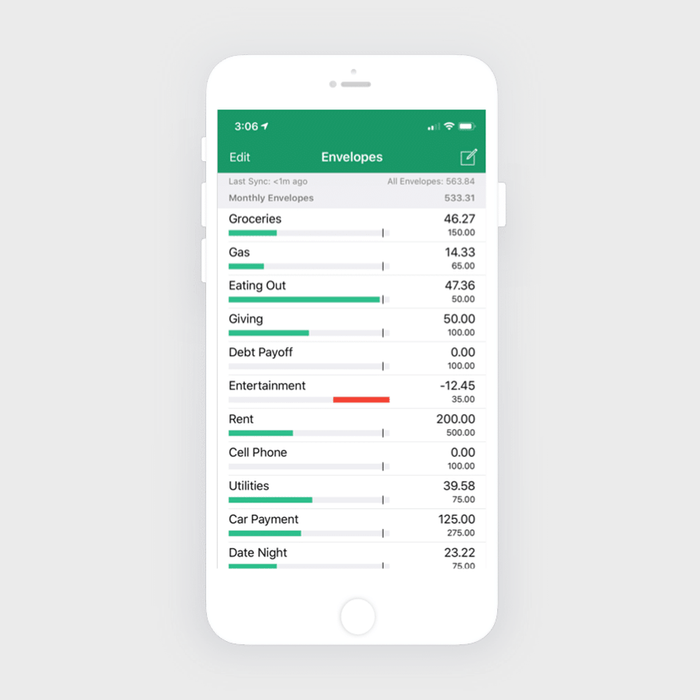

Goodbudget

You know the old-school budgeting method of keeping cash in labeled paper envelopes? Goodbudget is the digital version of that. Money for expenses is divided into categories such as gas, groceries, utilities, debt repayment and entertainment. When you spend money, you pull it out of the designated envelope, and when the envelope is empty, you either stop spending or pull from a different envelope to keep your overall spending on point. On Goodbudget, your outlay is tracked on your phone’s home screen, with bars that stay green if you still have money to spend and turn red if you don’t.

“I have been using the app for a year, and it has helped me do a complete 180 with my finances,” writes one reviewer. “I used to always be broke, living one paycheck to another, and now I have money saved and bills paid the second they arrive.” Read how a mom of three saved $13,000 in one year doing a few simple things and invested that “found” money for a more secure future.

Pros:

- Web-based option if you prefer not to use your phone

- Free version is fairly robust

Con:

- A paid version ($8/month or $70/year) is required for more than two devices and email support

Best for number-crunching

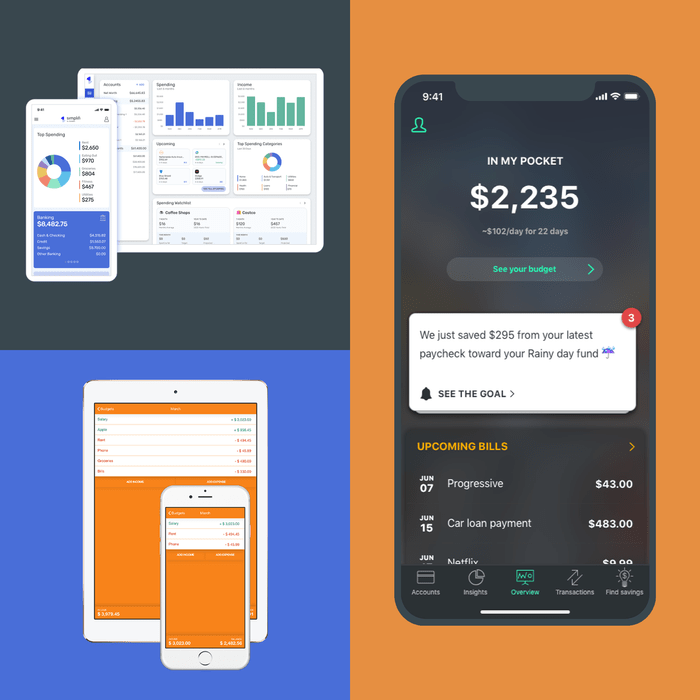

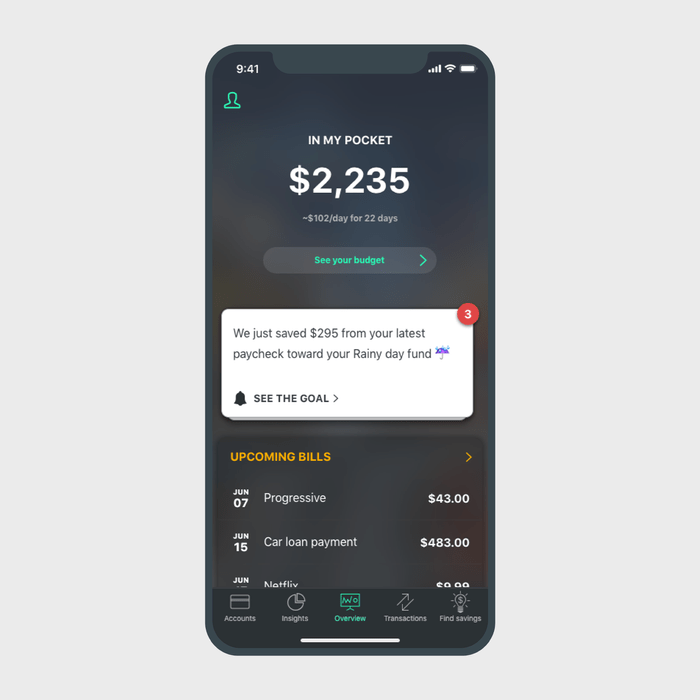

Pocketguard

Pocketguard makes our list of the best budget apps because it offers a unique feature called In My Pocket, which crunches numbers from all synced accounts and tells you how much money you have left to spend after your bills are covered. A pie chart illustrates the breakdown of where your money is going for a quick and comprehensive snapshot, and you can link accounts from thousands of institutions, including banks, mortgage lenders and credit card companies. With this budget app, you won’t have to make excuses anymore—or even think these things that money experts never say.

Pros:

- Synced accounts means Pocketguard always has the latest balances

- Helps predict future income, expenses and spending

Con:

- For the option of inputting data manually or exporting to Microsoft Excel, you need the paid version, PocketGuard Plus ($4.99/month or $34.99/year)

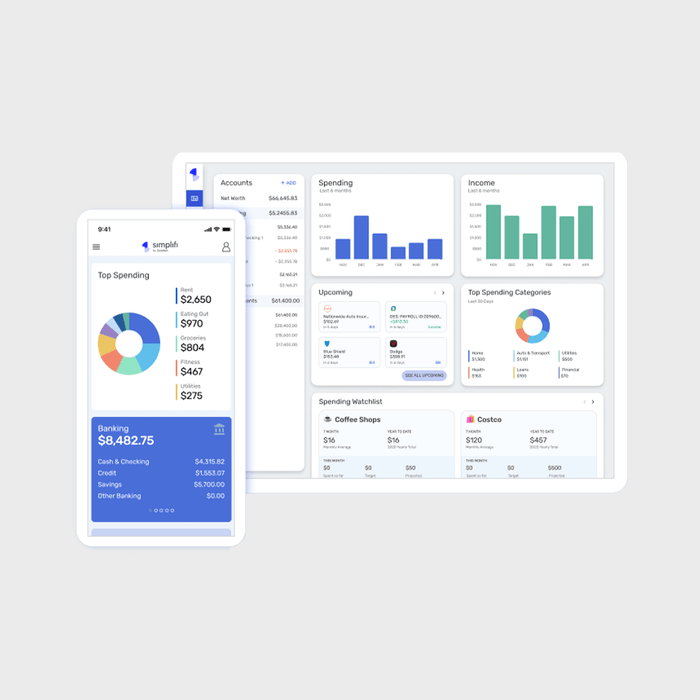

Best for busy people

Simplifi

According to Simplifi’s home page, this budget app will help you “stay on top of your finances in under 5 minutes per week.” Developed by Quicken, a leader in the business financial management software field, Simplifi sets up a flexible starter spending plan for you and generates a dashboard, so you can see where you stand at a glance. From there, you can add custom savings goals and more. The most time-consuming part of this is linking your accounts, but after that, you should be good to go. Reviewers say it’s a “game-changer” and that they’re “obsessed.”

Pros:

- Automatically generates a personalized budget

- Easy to set financial goals and track progress

- The website and mobile app integrate seamlessly

Con:

- Must convert to a paid plan ($5.99/month or $47.99/year) after the 30-day free trial

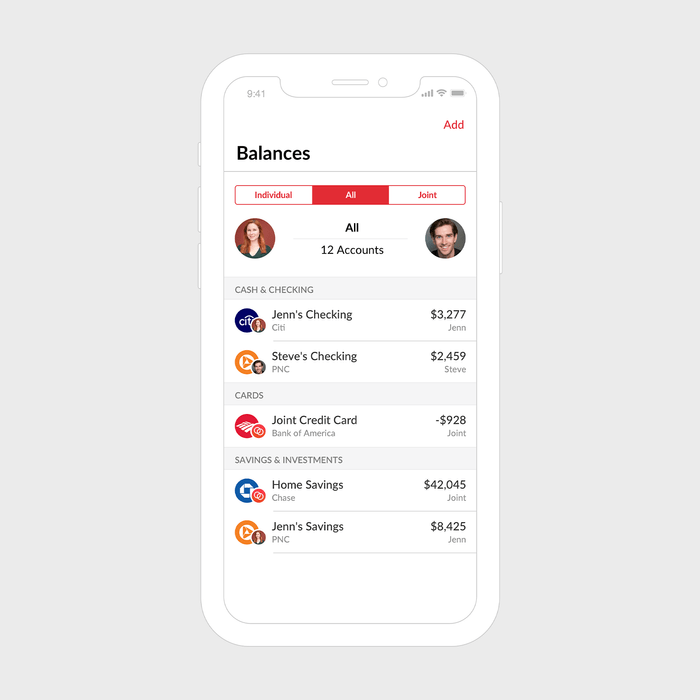

Best for couples

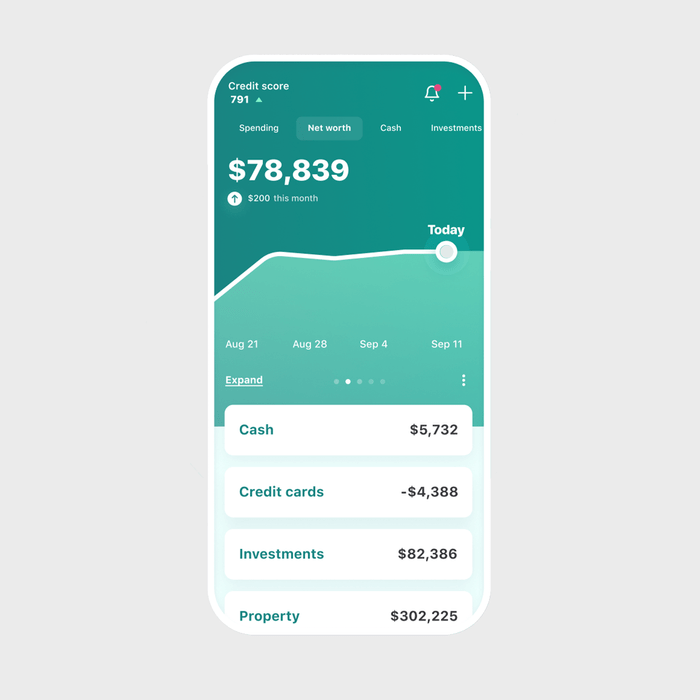

Honeydue

Looking to work with your significant other to manage your money? You just might fall in love with Honeydue, our pick for the best budget app for couples. On it, you can track all your bank accounts, loans, credit cards and investments, and easily communicate about money matters via a chat feature. Partners can choose to share all account and transaction information or just some, and the app breaks down into three sections: one for each person’s individual expenses, plus a third for shared expenses. Transactions are assigned to more than a dozen preset categories, or you can customize your own.

Honeydue also offers a no-fee, no-minimum-deposit-required, FDIC-insured joint bank account (called JointCash) if a couple wants to establish one.

Pros:

- Can connect with more than 20,000 financial institutions across five countries

- Sends reminders to pay bills with upcoming due dates

- Can set up a joint bank account on Honeydue, with no fees and no minimum deposits

Con:

- No desktop platform

Sources:

- Pew Research Center: “In the U.S. and around the world, inflation is high and getting higher”

- Sara Rathner, personal finance expert at NerdWallet

- Julie Ramhold, consumer analyst at DealNews.com