What Is Shrinkflation—and How Does It Affect Your Grocery Budget?

Updated: Apr. 11, 2023

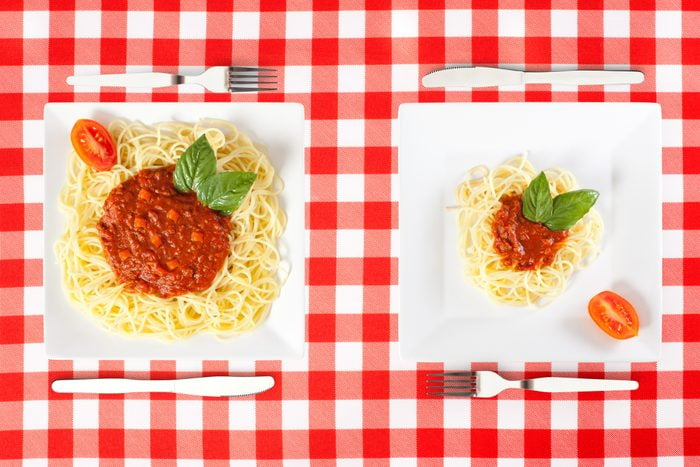

You're still paying $4 for a container of ice cream, but now it weighs 14 ounces instead of 16. That's shrinkflation.

We all know it by now—the pandemic has caused things to get more expensive. Producers are paying more for energy, labor and transportation, and they’re passing the cost on to consumers. Rising gas prices are obvious, but at the grocery store, shrinkflation can look like products with suspiciously smaller amounts selling for the same price as before. Or, the products themselves might be changing—the milk, cream and sugar in your favorite ice cream might be replaced with cost-saving bulking agents like corn syrup solids and whey protein.

The Consumer Price Index may not even reflect all these shifts: It doesn’t adjust food prices for changes in quality the way it does for some other items, such as clothing, appliances and phones. The CPI does normally account for changes in product size, but Bureau of Labor Statistics economist Jonathan Church admitted to the Washington Post in 2021 that pandemic restrictions had impacted the bureau’s ability to track changing weights. That means it’s become harder than ever to save money on groceries.

Why do companies use shrinkflation?

Shrinkflation is nothing new: Companies have used the practice for decades to offset rising production costs, but it didn’t always have such a catchy name. Pippa Malmgren, PhD, economist, author and former White House advisor, is credited with coining the term as we use it today. She uses it in her 2015 book, Signals: How Everyday Signs Can Help Us Navigate the World’s Turbulent Economy, and in interviews in 2014.

Malmgren has said shrinkflation (formerly known as downsizing) can be a precursor to rising prices—which certainly feels like the case in 2022, when the term has been used to incite curiosity and alarm in headline after headline. Consumers have noticed thinner toilet paper rolls, shorter deodorant sticks and airier chip bags. Seemingly, no product is immune, not even pet food.

What causes shrinkflation?

Higher production costs aren’t the only source of shrinkflation. In countries where sales taxes are built into retail prices, a tax hike can lead to shrinkflation. This happened in the United Kingdom in 2011, when the value added tax (VAT) went up but retailers didn’t want to raise prices.

Shrinkflation can also occur when a company reformulates a product or changes its packaging, potentially for reasons unrelated to labor and commodity prices—like removing an undesirable preservative. Of course, companies can also do both these things without decreasing serving sizes, as the Coca-Cola Company did with Coke Zero in 2017 and 2021.

How shrinkflation impacts shoppers

You might never realize things are shrinking: At least, that’s what brands are hoping. They figure consumers are more sensitive to higher prices than smaller sizes, so they reduce weight and volume first. Luckily there are consumer advocate’s websites like Mouse Print that help to tip consumers off to shrinkflation.

Seeing what groceries cost the year you were born can put today’s prices in perspective: As inflation surged in 1970, a dozen eggs cost consumers about $4.50 (in today’s dollars). At the start of July 2022, they cost about $3, with demand remaining high and supplies struggling to keep up. In fact, food prices overall increased by 10% from May 2021 to May 2022, the largest year-over-year increase since 1981.

How to stop paying more for less

Shrinkflation means that if you’re on a tight grocery budget, you may have to change what you buy and how you shop. Here are some tips for keeping costs in check.

Plan ahead

“Shoppers should do everything they can to avoid impulse purchases,” says Kevin Payne, a budgeting expert for Family Money Adventure. “The best way to do this is to meal plan each week. That way, you are only shopping for what you need.”

Limiting your shopping trips is another way to achieve this goal. “If you missed something, add it to your list for next week, unless it’s a necessity,” Payne says. Shopping for groceries online could reduce your impulse to grab extra items that look tempting in-store.

Prioritize your shopping list

Certain items are necessities, while others are nice-to-haves. Shop with a plan that puts your budget toward nutritious staples before incorporating desserts and soft drinks.

You don’t have to cut out the fun parts of your list entirely. But you might have to skip the LaCroix this week so you can stock up on your favorite chocolate chips while they’re on sale.

Use coupons

“Coupons do not have to be super complicated,” says financial adviser Claudia Gonzalez, who blogs at Wise Dollar Mom. “You don’t need to spend hours trying to figure out how you can pay five cents for an item.”

Instead, she recommends checking out grocery stores’ apps to look for specials and manufacturer coupons for the items on your list, and stopping at two stores on your grocery run if it will save you money. Using grocery apps is one of the ways this woman saves $4,800 on groceries per year.

Consider credit card rewards

“If you shop with credit cards, find one that rewards grocery store spending,” Payne says. “It won’t save you money up front, but you can recoup some of the cost through cash back or travel rewards.”

For this strategy to work, it’s best to pay your credit card bill in full and on time, and avoid carrying a balance. The interest charges will outweigh the rewards. You also need to know which retailers your credit card issuer classifies as grocery stores. Big box stores like Walmart and Target usually don’t fall under that umbrella, Payne says. These gas credit cards can also help you save.

Be flexible with brands

Many of us have certain items where we think paying extra for the name brand is worth it. For items you feel less strongly about, consider buying whichever label offers the best bang for your buck that week, whether it’s the store’s private brand or a name brand you haven’t tried before.

Use what you have

Many of us have no idea what’s in the back of our pantries. Empty everything out onto the kitchen counter and take inventory. Start building your grocery lists around these forgotten items so you can use them before they go bad, while also buying less.

Do the math

Is it cheaper to buy in bulk from Costco? Maybe. But you won’t know unless you calculate the per-unit cost. Pull up the calculator on your smartphone and divide the item’s price by the number of ounces. You can do this to compare different sizes of the same brand, or similar products from different brands.

The Fair Packaging and Labeling Act requires companies to put the “net quantity of contents in terms of weight, measure or numerical count” on food products “to facilitate value comparisons and to prevent unfair or deceptive packaging and labeling.” Use the law to your advantage.

Switch stores

It’s true: Shopping at a discount grocer like Aldi might not offer all the bells and whistles, but paying extra for ambience doesn’t make sense when it’s more important to get everything on your list.

Substitute for pricey ingredients

Recipes are written a certain way for a reason—just ask anyone at America’s Test Kitchen. Still, there are times when you can make affordable substitutions without ruining dinner, like choosing walnuts instead of pine nuts to make pesto.

Go meatless

“Meats like beef and chicken are always expensive, but even more so now,” Payne says. “Planning one or two meatless meals each week will reduce your bill considerably.”

Meat, poultry, fish and egg prices were more than 14% higher in June 2022 than a year earlier, according to the U.S. Bureau of Labor Statistics. The USDA also forecasts that beef prices will rise by 9.4% in 2023.

Is there a positive side to shrinkflation?

Not everything is getting more expensive. Check out your online order history or old grocery receipts. Not only is this a great way to see how shrinkflation is affecting you, but you might be reassured to see that some prices and sizes haven’t changed. Target still sells seven ounces of sliced Havarti for $2, and Costco’s rotisserie chicken is still $5. Also, while milk prices over the years have risen and fallen, cow’s milk is cheaper today than in previous decades.

Cutting back, going without and changing habits aren’t fun for anyone. However, learning new ways to save money and be a savvy consumer can pay off in the long run. If you’re willing to give the above tips a try, you might even find that the benefits go beyond sticking to your budget, from discovering new products and trying new recipes to reducing food waste.

Sources:

- Bureau of Labor Statistics: “Quality Adjustment in the CPI“

- Bureau of Labor Statistics: “Consumer Price Index Frequently Asked Questions“

- Washington Post: “One Way Companies Are Concealing Higher Prices“

- U.S. Department of Agriculture: “Livestock, Dairy, and Poultry Outlook: May 2022“

- Mirror: “VAT Rises but Food Shrinks“

- The Coca-Cola Company: “Best Coke Ever?“

- U.S. Department of Agriculture: “Egg Markets Overview, July 8, 2022“

- Bureau of Labor Statistics: “Consumer Price Index – June 2022“

- Claudia Gonzalez, financial advisor and blogger at Wise Dollar Mom

- Kevin Payne, budgeting expert for Family Money Adventure

- Federal Trade Commission: “Fair Packaging and Labeling Act“