One way seniors can ease those cost burdens while taking care of their health is by making the most of the benefits provided through their health insurance plans. If you are enrolled in Original Medicare or a Medicare Advantage (MA) plan (which includes the same coverage as Original Medicare plus additional benefits), understanding the benefits that can help you identify health problems early or prevent them completely is particularly important for your physical and financial well-being.

Here are five recommendations that are key to prevention and healthier outcomes:

1. Schedule an annual wellness visit with your healthcare provider.

Don’t wait until you are sick or in pain to see your healthcare provider. Take advantage of the annual wellness check that is fully covered by Medicare Part B. If you’re enrolled in a MA plan, a convenient option may be to have an in-home health and well-being assessment.

During the visit, your provider will assess your health risks; discuss screenings, vaccinations and other recommended preventive services based on age, gender, and medical and family history; and perform a cognitive assessment to look for signs of impairment. Then your provider can develop a personalized plan to help prevent disease or disability.

2. Take advantage of covered preventive services and vaccinations.

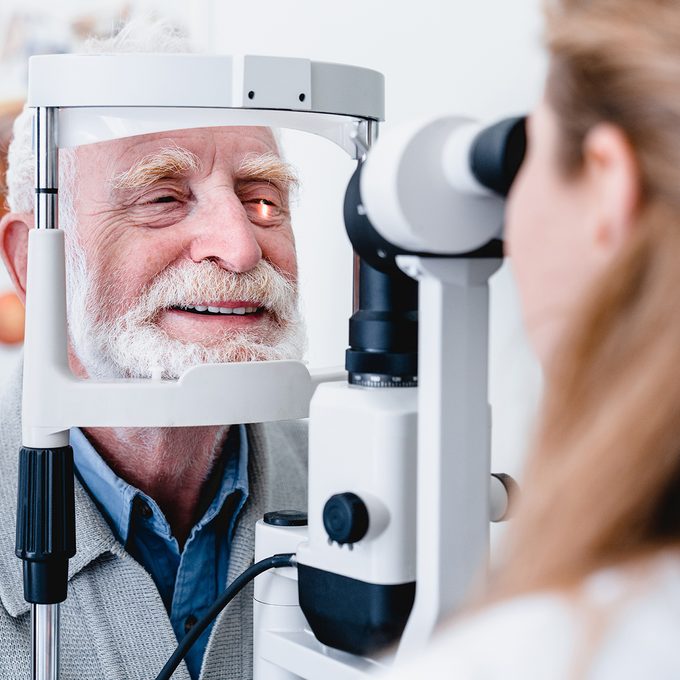

Preventive screenings are crucial to early diagnosis and treatment and ultimately may result in improved long-term health outcomes. Medicare Part B coverage includes screenings for many common health problems, like cardiovascular disease, cancer, diabetes, depression and glaucoma. It also covers counseling for weight loss, tobacco use and alcohol misuse.

With older adults being at higher risk for complications from flu and COVID-19, it’s important to stay current with vaccinations. Medicare covers the cost of vaccines for COVID-19, flu, pneumonia and hepatitis B.

3. Check your dental, vision and hearing coverage.

Individuals with a Medicare Advantage plan have coverage beyond Medicare Part B that may offer additional health-related benefits including dental, vision and hearing coverage, so take advantage of those additional preventive care services.

Tooth and gum problems can increase your risk of diabetes, heart disease and stroke. Your plan may cover dental care and procedures to maintain your oral health and even provide allowances to pay for out-of-pocket expenses.

Your plan may also include coverage for eye exams and glasses, which can help you avoid problems associated with poor vision, including a decreased ability to perform daily activities and an increased risk for depression.

Hearing loss can lead to social isolation, loneliness and frustration. Hearing exams and hearing aids, which your Medicare Advantage plan may cover, can help counter those effects.

4. Be aware of benefits beyond traditional coverage.

Medicare Advantage plans can include supplemental benefits that go beyond the typical coverage to support good health.

Staying physically active is good for both your body and your mind and is especially important as we age. Gym memberships and Silver Sneakers® classes are available through some MA plans so you can keep fit and save money at the same time.

If a lack of transportation is preventing you from getting to medical appointments, check to see if your Medicare Advantage plan provides transportation assistance.

For eligible members, some Medicare Advantage plans offer a flexible spending option that provides a set dollar amount to be used for essential living expenses that can be critical to a person’s health. These benefits, like Humana’s Healthy Options allowance, may cover groceries, rent and utilities, and many over-the-counter items.

Medicare Advantage plans may also cover expanded benefits such as home-based palliative care, in-home support services, caregiver support and therapeutic massages.

5. Know What’s New in 2023

With the passage of the Inflation Reduction Act, Medicare Advantage plans with prescription drug coverage will now provide most Part D vaccines, including the shingles vaccine at no cost. Additionally, for those with prescription drug coverage, insulins will not cost more than $35 for a 30-day supply.

Prioritize your health this year by taking the time to understand and use the benefits in your healthcare plan. It will be good for both your health and your finances. Visit Medicare.gov to learn more about covered services.

Additional Information

Humana is a Medicare Advantage HMO, HMO SNP, PPO, PPO SNP AND PFFS organization with a Medicare contract. Enrollment in any Humana plan depends on contract renewal. Allowance amounts cannot be combined with other benefit allowances. Limitations and restrictions may apply.

Y0040_GCHLWNWEN_M