What are buy now, pay later apps?

Buy now, pay later apps (BNPL) allow users to finance their purchases into smaller, equal installments, often interest-free and with minimal fees. These apps may offer four-payment installments or longer-term financing for a variety of purchases (electronics, clothing, jewelry and more) from thousands of well-known retailers. For those who appreciate how to coupon or how to get free stuff, some apps even feature loyalty programs with discounts, in-app deals and rewards when you pay on time.

With rising costs and inflation, tech-smart shoppers are learning how to save money and how to make money fast and using budget apps and BNPL platforms as powerful financial tools. In fact, thanks to their flexible payment plans, BNPL purchases jumped 68% during Black Friday week, according to an Adobe Analytics report.

Popular among people of all ages who want to stretch their paychecks or make big-ticket items more accessible, you can expect BNPL apps to split up your payments over weeks or months.

Understanding the risks of buy now, pay later apps

Companies such as Klarna and Afterpay are just two of the buy now, pay later apps popularized by tempting zero-interest payment plans. And while this type of financing has its benefits, many financial experts have raised caution flags, advising consumers to avoid using these services impulsively. These are loans, after all. If mismanaged, it’s a slippery slope into unsustainable debt, as BNPL services can impact your credit, saddle you with fees and hidden interest and leave you with fewer consumer protections than credit cards.

In general, paying off purchases in full is always the most financially responsible and least risky option. Before purchasing through BNPL services, understand your financial situation. Can you afford to borrow and pay back the loan? Do you have the ability to manage multiple payments and pay on time? Avoid using BNPL apps for unneeded items. If it’s a necessary purchase (a new phone, mattress or computer, for instance) and you’re certain you can make the monthly payments, buy now, pay later apps might be an option for you. Just remember, they’re not all created equal—some are not interest-free, some affect your credit and many will charge a fee if you miss a payment.

How we chose the best buy now, pay later apps

If you’ve reviewed both the benefits and risks, find out which provider is best for you. Which offers the best terms? Which is most user-friendly? By conducting market research (including trying out Klarna, Affirm and Paypal’s BNPL features), reviewing customer ratings and reading through the fine print, we compared the most important buy now, pay later features, including ease of use, interest charges, missed payment policies and more.

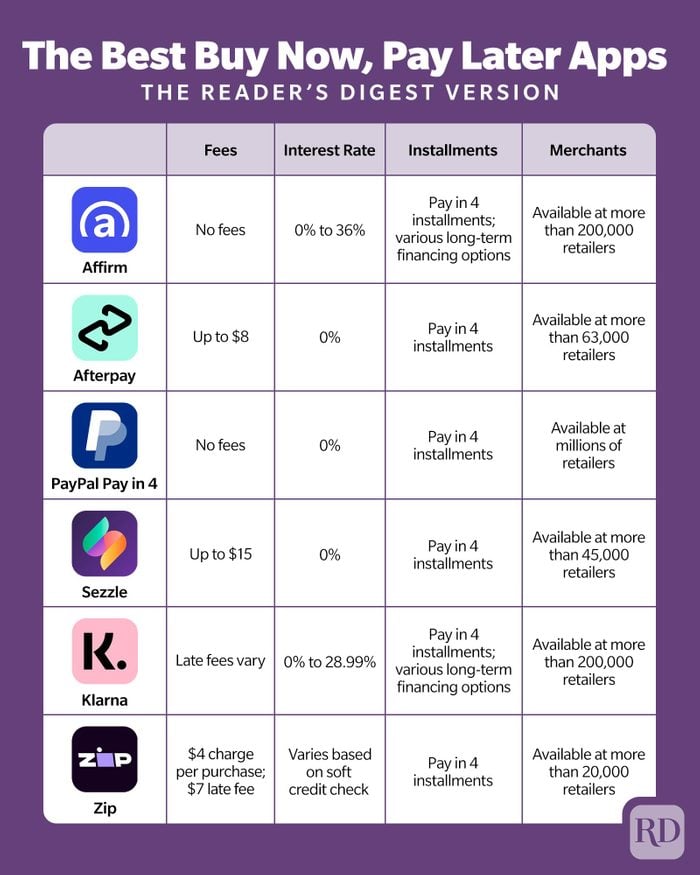

Here are our picks for the best buy now, pay later apps:

- Best overall: Affirm

- Best for new budgeters: Afterpay

- Best for online shopping: Paypal Pay in 4

- Best for exclusive in-app deals: Sezzle

- Best for earning rewards: Klarna

- Best for bad credit: Zip

Best overall

Affirm

Available on: Apple App Store, Android Google Play

Affirm is our choice for the best overall buy now, pay later app because it offers a wide range of financing options for big and small purchases made in-store or online. For everyday orders, Affirm Pay in 4 splits your purchase into four interest-free payments every two weeks, starting at checkout. If you’ve been putting together a sinking fund for a big-ticket item like furniture or vacations, Affirm also offers monthly installments (over three, six or 12 months) with no hidden fees and easy, automatic payments made in the app. Loan amounts for monthly installments depend on the price of items as well as prequalifying factors, including credit score. And interest rates can vary from 0% to 36% APR, depending on the merchant.

Here’s an added bonus: Thousands of merchants have Affirm integrated directly at checkout, including Wayfair, Lowe’s, Walmart and Amazon. For stores not affiliated with Affirm, you can prequalify in the Affirm app and use a one-time-use virtual card to shop almost anywhere else.

Pros:

- Flexible in-app and in-store use for small- and large-ticket items

- No fees, including annual fees, late fees or fees to open and close your account

- No interest for Affirm Pay in 4

- Eligibility for the Affirm Pay in 4 option requires a soft credit check that has no impact on your credit profile

Cons:

- Possible high interest rates on large-ticket items and larger loans

- Larger loans are subject to traditional credit checks

Best for new budgeters

Afterpay

Available on: Apple App Store, Android Google Play

What do people who want to retire early (also known as the FIRE movement) have in common? They’re financially independent and savvy. Afterpay is our choice for new budgeters because it’s easy to use, interest-free and has features that encourage users to stay financially responsible. The intuitive interface of this buy now, pay later app means you can easily view and track purchases and plan for upcoming payments. Payment reminders are available, and you can reschedule payment dates if needed without penalty.

Similar to Affirm, Afterpay can be used in-store or online at thousands of retailers, including major brands like Adidas, Lululemon, Old Navy and Anthropologie. It’s integrated at some merchants, while others require the use of the Afterpay app. Like others on the list, it uses a no-interest, pay-in-four payment schedule, with the first one due at checkout and the remainder due every two weeks over six weeks. If you miss a payment, your account will be automatically paused.

Larger loan amounts vary according to multiple factors and will gradually increase with time using the app (consideration is made to sufficient funds in your credit or debit card, as well as any other outstanding loans with Afterpay).

Pros:

- Easy payment tracking, payment reminders and the ability to reschedule payment dates

- No interest or fees when payments are made on time

- Afterpay includes a free rewards program called Pulse that unlocks exclusive benefits

Con:

- Possible $8 late fee if payment isn’t received by the end of payment grace period

Best for online shopping

PayPal Pay in 4

Available on: Apple App Store, Android Google Play

PayPal Pay in 4 is our choice for online shoppers because it’s integrated directly at checkout for lightning-fast transactions. Whether you’re shopping smarter for household essentials, finally booking travel online or spending on things money experts buy cheap, PayPal’s Pay in 4 is interest-free, features PayPal purchase protection and is widely trusted. While you can download the PayPal app, “Pay in 4” is available at millions of merchants online (not offered for in-store shopping) and integrated directly at checkout.

With no interest charged, no fees (even with late payments) and a four-payment schedule (the first at checkout and the remainder every two weeks over six weeks), PayPal’s buy now, pay later option is similar to other apps. Eligibility for the Pay in 4 option does require a soft credit check though, but it has no impact on your credit profile.

Pros:

- Easily integrated directly in the checkout of major e-commerce retailers

- No interest or fees

- Eligible items are protected by PayPal Purchase Protection

- Loans are offered for purchases between $30 and $1,500

Cons:

- You cannot use PayPal Pay in 4 in-store

- Not currently available to residents of Missouri, Nevada, New Mexico, North Dakota, Wisconsin or any U.S. territories

Best for exclusive in-app deals

Sezzle

Available on: Apple App Store, Android Google Play

Through its app, Sezzle provides unique deals, special offers and ways to save (even on things that will cost less in 2023) at more than 45,000 stores. Beyond being one of the best buy now, pay later apps, Sezzle gives its users the chance to explore and curate their favorite stores and shop directly from the app.

Broken into four payments (one due at checkout and the remaining three due every two weeks), Sezzle is also flexible, building in one free reschedule (up to two weeks later). No interest charges exist on purchases, nor do late fees. Sezzle does have fees for a second rescheduling of payment dates though. Eligibility for Sezzle requires a soft credit check that has no impact on your credit profile. Spending limits may vary, and loan amounts start at $35 but can vary based on the length of time you’ve used Sezzle, your soft credit check results and order history.

Pros:

- Discounts, deals and promotions are available in-app when shopping with Sezzle

- Sezzle has semi-flexible payments, with one free rescheduling built in

- No interest fees

Con:

- Fees for second payment rescheduling and failed payments

Best for earning rewards

Klarna

Available on: Apple App Store, Android Google Play

Our choice for best rewards club, Klarna gives users the chance to earn one point for every $1 spent with Klarna. You can choose at which store you want to redeem your rewards, while also collecting that store’s rewards points. Rewards can get you exclusive access to deals, content and other perks.

One of the fan-favorite buy now, pay later apps, Klarna can be used online or in person at more than 200,000 stores and marketplaces, like Etsy, Bed Bath & Beyond and Macy’s, or by shopping directly in the app. For those meal planning, budgeting a grocery list or just dealing with shrinkflation (rising cost for smaller goods) on necessities, using high-reward BNPL apps like Klarna for necessities could be a solution.

Like other pay-in-four options, Klarna’s users pay the first installment at checkout, followed by three payments every two weeks. Some orders may be eligible for their Pay in 30 option. Klarna’s longer-term financing loans have no specific limit, are offered in payment schedules that vary from 6 to 36 months and are subject to an APR between 0% and 28.99%. And while their Pay in 4 program doesn’t have an interest fee, shoppers are charged a late fee if they miss a payment.

Pros:

- Earn one reward point for every $1 spent using Klarna

- Flexible payments allow for Pay in 4, Pay in 30 or financing from 6 to 36 months

- No interest fees for Pay in 4 or Pay in 30

Cons:

- Missed a payment? You have 10 days before being hit with a late fee of up to $7

- High interest rate for financed purchases

- Longer-term financing is subject to a hard credit check that may affect your credit score

Best for bad credit

Zip (previously Quadpay)

Available on: Apple App Store, Android Google Play

Not only does Zip not perform a hard credit check when you apply, but they also don’t report to major credit bureaus. This makes it a great choice if you have bad credit or you wish to sidestep potentially troublesome credit checks. Plus, you can shop anywhere Visa is accepted.

Learning how to save money on groceries? Zip could be your answer. Order groceries, book a trip, pay your bills and more—just make the first payment at checkout and the remaining three every two weeks. Keep in mind that Zip’s interest rates are based on your soft credit check, and they charge a $1 fee for every installment payment you make. Depending on the merchant and total cost, this charge may be greater. Late fees also vary depending on your state of residence.

Pros:

- No hard credit check or credit reporting

- Doesn’t report to major credit bureaus

Cons:

- Zip charges a $1 fee for each payment, so every purchase with Zip will cost an extra $4

- Loan amounts go up to $1,000, but you can request an increase after six months of use

Compare the top buy now, pay later apps

With so many popular buy now, pay later apps on the market, it can be tricky figuring out which app is best for you. Ultimately, it comes down to how you’ll be using BNPL services and where. When used strategically, with awareness of fees and interest, BNPL can be a useful tool to help keep you on track with your budget and start to build an abundance mindset.

Sources:

- Adobe Analytics: 2022 Holiday Shopping Insights

- MarketWatch: “Buy Now, Pay Later Revenue Jumped 72% Last Week”

- Affirm: “Payments overview”

- Afterpay: “Help centre”

- PayPal: “What is Pay in 4?”

- Sezzle: “Need some help with Sezzle?”

- Karna: “Customer Service”

- Zip: “What is Zip?”