The 3 Most Common LinkedIn Scams and How to Spot Them

Updated: Feb. 01, 2024

LinkedIn is a valuable networking resource, but it's also attractive to fraudsters. Here's what you need to know about common LinkedIn scams to stay safe.

One of the top things to do after a layoff is update your LinkedIn profile, though it’s wise to have an updated profile prepared in case you unexpectedly lose your job. But while you’re updating your skills, sprucing up your brand and announcing you’re open to work (while also avoiding typical LinkedIn profile mistakes), you need to be aware of the common LinkedIn scams you may unwittingly come across.

Online scams are everywhere these days, and it’s critical that you take your online security seriously. As you build up your LinkedIn profile and connections, pay attention to the telltale signs you shouldn’t accept a LinkedIn request, and if someone unfamiliar sends you a message with a link, don’t click it. You could become the next victim of wire fraud or a bank scam if you do.

Con artists prey on those they perceive as vulnerable. If you’re job hunting on LinkedIn, don’t be surprised if someone approaches you with a get-rich-quick crypto scam or a job opportunity that turns out to be nothing more than a work-from-home job scam. “The cardinal rule of the internet ought to be ‘If it’s too good to be true and it costs you money, it’s probably a scam,'” says Monica Eaton, chief operating officer of Chargebacks911.

Get Reader’s Digest’s Read Up newsletter for humor, cleaning, travel, tech and fun facts all week long.

The growing problem of LinkedIn scams

LinkedIn is no stranger to scams, and the issue is only increasing. The first six months of 2022 saw about 5.5 million more fake accounts on the platform than the previous six months.

“The easy explanation for why LinkedIn scams have become so prevalent is that in every scam, it’s a matter of getting someone to trust you, and frankly, people tend to trust the LinkedIn platform,” explains Steven J.J. Weisman, an expert in scams, identity theft and cybersecurity. “In addition, LinkedIn has 810 million members, so it is a large, trusting audience for scammers.”

Blair Heitmann, a LinkedIn career expert, reports that most fake job postings are stopped before going live. “Ninety-nine percent of detected spam and scams are caught before they reach our members,” Heitmann says. “We also encourage our members to report a job posting if something doesn’t seem right.”

This is excellent news. It means you can trust official job postings on LinkedIn. But that’s not where the current problem is. The issue is with bad actors who approach LinkedIn members privately with “job opportunities” that turn out to be LinkedIn scams.

Can you be scammed on LinkedIn?

Yes, you can absolutely be scammed on LinkedIn. “Social network users are popular targets for scammers, and LinkedIn is no exception,” says Chris Hauk, consumer privacy champion at Pixel Privacy. In fact, LinkedIn offers certain draws that other social media sites don’t.

“LinkedIn scammers are attracted to that network due to the participants’ positions and perceived higher income and financial status,” Hauk says. “Scammers may be looking to scam IT professionals and financial professionals to separate them from important business-related information or to trick them into giving up information or their hard-earned funds by dangling job opportunities in front of them that later turn out to be fake.”

It’s hard to tell for sure how many LinkedIn accounts are fake, but Andy Rogers, a senior assessor with global cybersecurity assessor Schellman, helps put it in perspective. “To give you an idea of how many fake accounts are out there, in 2021 alone, 32 million fake accounts were removed from LinkedIn,” he says.

On top of that, the company prevented 11.9 million accounts from launching because they were deemed fraudulent during registration. And it restricted another 4.4 million for other reasons. That’s close to 50 million fake accounts.

How do scammers hook LinkedIn users?

Cybercriminals use catfishing techniques to lure in victims, though the process works differently with LinkedIn scams than with romance scams. Still, the mechanism behind it is the same.

“In a traditional catfish scam, the criminal is usually just after money,” explains Chris Pierson, PhD, CEO of BlackCloak, a concierge cybersecurity company for high-net-worth individuals. “But in a LinkedIn scam, the attacker may be part of a more sophisticated group—such as an organized cybercrime organization or a nation-state espionage group—where the ultimate goal is corporate cyber espionage, data theft, financial exploitation (similar to a business email compromise or gift card scam) or unauthorized access into the network.”

Because of their financial status, many of Pierson’s clients have been targets of LinkedIn scams. “Catfish scams are usually limited to a fake profile followed by social engineering that leads to a financial request,” he says. “But on LinkedIn, a catfish scam can be much more involved, proceed over a longer timeframe and involve different tactics.”

The company is well aware of the issue, which means users have at least a few tools to combat phonies. “We recently shared an update on new profile-verification features to help you assess the authenticity of someone’s LinkedIn account,” Heitmann says.

Despite the scammers, using LinkedIn is still generally safe, but it’s recommended you vet the people you communicate with carefully. “It is safe to use LinkedIn while keeping certain precautions in mind, such as not entertaining the conversation of financial advice or falling for a discussion of early profit,” says Vandan Pathak, a senior application security consultant at Optiv, a firm devoted to cybersecurity solutions.

Common LinkedIn scams

The majority of LinkedIn scams come from fake LinkedIn profiles—it’s what the con artists do with the fake profiles that determines the type of scam. The three below are the most common swindles on the platform.

1. Fake job offers

When you announce you’re open for work (a wise move when job hunting, so continue doing it!) you also open yourself to scammers. “These types of scams are very popular on LinkedIn, and many people who are actively seeking a job tend to fall for such traps,” Eaton says.

A fake job offer will likely double or triple your current salary, but the recruiter will demand a finder’s fee ahead of time to put you in touch with the company. “A fake recruiter may claim that you need to respond right away or this incredible job will go to someone else,” she says. “And because FOMO [fear of missing out] is a real thing, you might consider it for the opportunity of a lifetime. But remember that legitimate job recruiters don’t rely on such high-pressure tactics.”

Heitmann tells LinkedIn users to be aware of job opportunities that offer high pay for very little work. “These opportunities can include mystery shopper, company impersonator [and] work-from-home or personal assistant posts,” she says. “If the financials seem significantly above the market value for the role, it might be worth a closer look.”

How to avoid it: Keep in mind that legitimate companies won’t use a sense of urgency to motivate you to act—that’s a red flag. “Job applications might ask for [social security numbers] or other information used in identity theft,” says Paul Bischoff, a privacy advocate at Comparitech, a privacy and cybersecurity site. While it’s true that employers usually do background checks and ID verification, pay attention to all the details before handing over that information.

2. Fake tech support

A scammer claiming to work for your company may approach you, offering fake tech support to gain access to information or to get you to hand over your passwords.

“Scammers and cybercriminals use advanced social engineering techniques to learn sensitive information about your organization via the LinkedIn page,” Pathak says. “People usually don’t cross-check the person before disclosing sensitive details to these scammers.”

How to avoid it: If you work for a large corporation, it might be hard to keep track of the latest IT staff, but it’s essential to take the time to verify the person you’re speaking to on LinkedIn. It’s also unlikely that your company’s tech support will contact you through LinkedIn when they have access to your work email and phone number. Consider contact on the platform your biggest tip-off. And speaking of tech support scams, be on alert for Geek Squad scams too.

3. Phishing

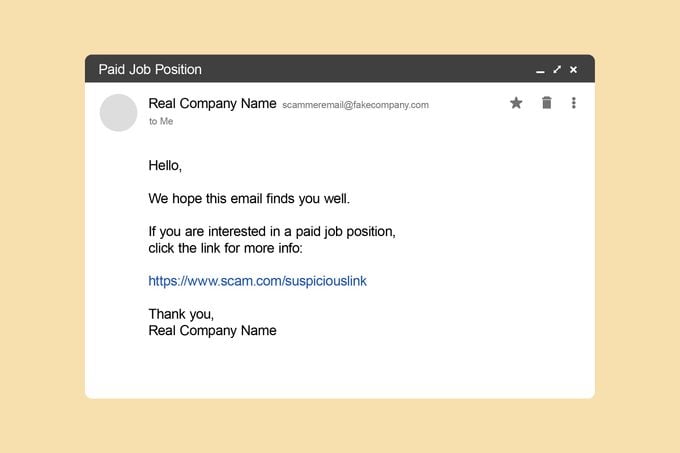

Phishing takes many forms: You’ll often come across phishing emails, texts (aka smishing) and phone calls (known as vishing). It continues to evolve as people wise up to the different scams, but it’s a real threat. With only one click on a sketchy link, you could have your account hacked.

The scam works like this: Fraudsters send you an email that looks like it’s from a legitimate company, including a link to what appears at first glance to be the company’s website. Click it, and you’ll end up on a site that may download malware or spyware onto your computer or ask for log-in details (that the bad guys will then steal).

“This is a very well-known scam technique where scammers phish you with something that looks real, with a goal to obtain any sensitive information they can, such as bank details,” Pathak says.

How to avoid it: The easiest way to keep yourself safe from phishing is to avoid clicking links from people you don’t know. “Don’t click on the link, and don’t type in your name and password,” Eaton says, offering the most basic—yet foolproof—way to protect yourself from phishing attacks.

Signs of a LinkedIn scam

They may come in many forms, but LinkedIn scams often share common traits. Consider the features below major red flags of fraud.

There’s a false sense of urgency

Fraudsters love a ticking clock, whether they’re running Facebook scams, Venmo scams or some other scheme.

“If you feel rushed to make a decision, stop to consider because it could be a scam,” says Bischoff. “Instilling a sense of urgency in victims is a classic tactic to force them into making poor decisions.” If you’re in a hurry, you might miss signs of a scam, but it’s easy to recognize the fakes once you know what to look out for.

The account is brand spanking new

Bischoff suggests using extra caution with profiles that are less than a month old, as they might’ve been created specifically to scam people. Luckily, LinkedIn introduced an “About this profile” feature in the fall of 2022, making it easier than ever to find out when an account was created.

Misspellings, grammar flubs and slang abound

Many LinkedIn scammers are based in foreign countries, and English isn’t always their first language. So look for misspellings, mangled grammar and slang, Eaton says. (That’s a good tip for avoiding Instagram scams, Zelle scams and other types of fraud too.)

“Although slang is prevalent on platforms like Twitter and Reddit, it’s not what you’d expect on a professional networking site like LinkedIn,” Eaton points out. “A high-ranking business executive should be able to write at an industry-appropriate level, and if they can’t, it might be cause for concern.”

The profile photo is a fake

If the person’s profile photo is phony, it’s a sign you’re dealing with a scammer. “Reverse image search the photo to see if it’s connected to other accounts or other platforms,” Eaton suggests. You can easily do a reverse image search on your phone, or use a handy site like Reverse Image Search.

A word of warning: As Eaton points out, AI-generated profile photos are now being used by some scammers. “Not all of them,” she says. “But as AI technology becomes cheaper and more available, we’re going to see its usage in fraud schemes rise.”

The connections seem contrived

One way to keep yourself protected from LinkedIn scams is to communicate only with people who share multiple connections with you. “It’s not easy for fake people to build real connections, so as a shortcut, scammers sometimes create multiple fake accounts, connect them all and even take the time to endorse one another,” Eaton says. “A small, intricate network of super-connected, super-supportive LinkedIn accounts that all share a common writing style is a warning sign.”

The endorsements are vague and similar

One way to spot a scam account is to look at the endorsements. Do the same people endorse this person and each of the person’s connections? Are the endorsements themselves almost identical? “If the endorsements are all suspiciously similar—such as something short, vague and unspecific to any one industry—that’s another warning sign,” Eaton says.

Consider how the endorsements fit into the bigger picture. They might not look suspicious at first glance, but they become massive red flags when paired with a new account, grammatical errors and connections linked to and endorsing one another. “If the constellation of facts is misaligned, it’s better to be risk averse and walk away than to double down on a fake account,” Eaton says.

They have a common last name

People who create fake LinkedIn accounts for nefarious purposes will use common names. While not every Smith, Jones, Miller or Johnson is a scammer, take a closer look at these accounts.

“It’s far more challenging to search online for very common names,” Eaton points out. “You’ll come up with a ton of crossmatches for a John Smith or a Mike Jones, but an account with an odd, unusual name is easier to pinpoint and verify. That’s why scammers tend to avoid them.”

The initial contact was awkward

Some scammers blast out messages and don’t personalize them. That’s a red flag, and it’s also worth a serious pause if the initial contact is overly formal. “If you are being contacted by someone in a senior position, it is most likely a scam,” Weisman says. “CEOs don’t generally contact people on LinkedIn. Contacts are generally made by HR employees or middle management.”

They ask for money or financial information

Ah, the financial ask. Romance scammer stories all include a request for money, as do a bunch of other scams, including wire fraud and those conducted on money-transfer apps.

Scammers may ask for money, perhaps for a job-related training, or they may ask for your banking details—these are both red flags. “LinkedIn is full of fake job ads that trick victims into giving up personal information or paying in advance for job-related expenses, only to find out that job doesn’t really exist,” Bischoff says.

As a good rule of thumb, if someone asks you for money over social media, walk away.

What to do if you’ve been scammed

Sometimes, by the time you identify a scammer, you’ve already been scammed. There’s no time to wait! Take action immediately.

“If you think you’ve been compromised by a scammer on LinkedIn, the first thing you should do is change your LinkedIn password and add multifactor authentication,” Pierson says. He also recommends that you:

- Scan for malware on your mobile device or computer.

- Swap easy-to-guess passwords for strong, unique passwords. (And stop using the same password for multiple accounts! If you need help remembering them all, use a password manager.) Don’t just update LinkedIn either; change your password for other important accounts, including your email, bank accounts, VPN, remote access and cloud storage. Then make sure you have multifactor authentication enabled for each of these accounts.

- Back up all your data.

If you were sent a phishing attempt, you can forward the message directly to LinkedIn at [email protected]. You can also notify LinkedIn by using this form.

“If you were scammed out of money, it’s important to notify your bank ASAP,” Eaton advises. The amount of money you can recover depends on how quickly you act and how you were defrauded.

“Credit cards and debit cards have different levels of consumer protection,” Eaton explains. Credit cards protect you far more comprehensively. “The money lost from a fraudulent crypto purchase can be tough to recover. Either way, you need to tell your bank so that they can protect you from further harm.”

You can also file a claim with the FBI’s Internet Crime Complaint Center and the Federal Trade Commission’s Report Fraud site. Your local police department could also help, since the crime happened to you in its jurisdiction.

Sources:

- Monica Eaton, chief operating officer of Chargebacks911

- Steven J.J. Weisman, expert in scams, identity theft and cybersecurity

- Blair Heitmann, LinkedIn career expert

- Chris Hauk, consumer privacy champion with Pixel Privacy

- Andy Rogers, senior assessor with Schellman

- Chris Pierson, PhD, CEO of BlackCloak

- Vandan Pathak, senior application security consultant at Optiv

- Paul Bischoff, privacy advocate with Comparitech

- LinkedIn: “Community Report”

- LinkedIn: “Working together to keep LinkedIn safe”