12 Common Venmo Scams to Watch Out For

Updated: Mar. 18, 2024

Payment apps have made transferring cash more convenient than ever, but some thieves are setting up Venmo scams to steal your money

On This Page

Can you get scammed on Venmo?

These days, you can pay for pretty much anything without using your wallet, thanks to money-transfer apps like Venmo. But the convenience of using these apps also comes with a fair share of risk, especially as Venmo scams become more commonplace.

“Venmo can be a tool used in many different scams,” says Eva Velasquez, president and CEO of Identity Theft Resource Center. In some, fraudsters impersonate Venmo customer support; in others, they request money with a fake link. In all, bad actors aim to steal something from you, whether money, personal information or both. Thankfully, there are several red flags that make Venmo scams easier to spot.

To protect your financial and personal information, watch out for these common Venmo scams, which could leave you and your money vulnerable to criminals. Once you’re up to speed, find out how to protect yourself from common online scams on Cash App and Zelle. They, too, put your online security at risk.

Is Venmo safe?

Considering the talk of Venmo fraud, it’s understandable if you’re wondering, Is Venmo safe to use at all? Rest assured that the app itself isn’t a scam. “Venmo is considered safe as long as the proper precautions are taken,” Velasquez says.

In addition to encrypting your financial information and transactions, Venmo offers other layers of security, like PIN numbers and multifactor authentication that make it more difficult for cybercriminals to access your account. Velasquez recommends activating each of these security features to keep your info safe.

But there is one security downside to using Venmo: Unlike credit or debit cards, which offer financial protection for consumers in the case of fraud or theft, digital payment services like Venmo treat your money like cash. Once the money has been transferred to a scammer, it’s almost impossible to recoup the loss.

This isn’t just a Venmo problem, though. Other contactless payment apps, including Apple Pay and Google Pay, are also vulnerable to scams.

Common Venmo scams to look out for

A more important question than “Can you get scammed on Venmo?” is “How exactly do you spot a Venmo scam?” The first thing you need to know is that the bad guys are sneaky and often very convincing. But their scams also tend to have some common themes. Read on for some of the most prevalent Venmo scams—and how to avoid them.

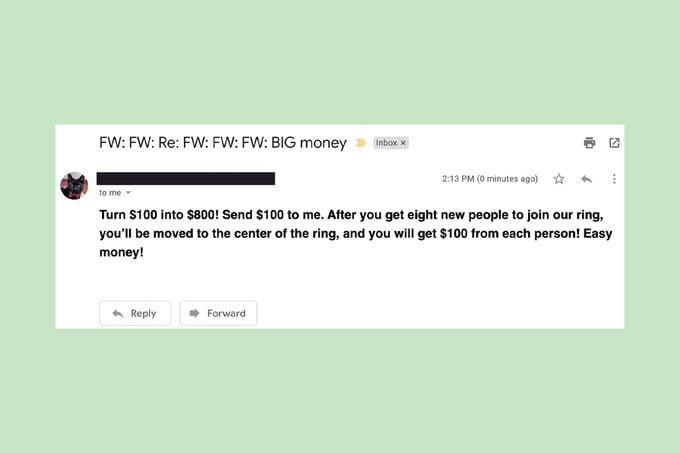

1. Offering to increase your money

In one typical Venmo scam, criminals might ask you to send them a small amount of money to receive a larger amount in return. For example, they may promise that if you send them $200, you will get $2,000 back in one week.

This scam goes by several different names, including a money circle, cash wheel and pyramid scheme. Whether the request comes from a stranger or someone you know, it’s likely that you will never receive any money back, according to Adam Gordon, a digital security expert and instructor at ITProTV.

How to avoid it: Steer clear of anyone who promises to increase or “flip” your money after you send them funds via Venmo. As a rule of thumb, too-good-to-be-true opportunities are red flags of a scam. “Common sense wins the day,” Gordon says. “If it seems too good to be true, it probably is.”

While you’re at it, be sure you know how to spot fake donation scams too.

2. Accidentally sending you money

Receiving a random Venmo transfer is not always an honest mistake. In fact, scammers use this “high-tech twist on a classic con” to trick you into giving them money, according to the Better Business Bureau.

The fraudster might use a stolen credit card or bank account number to transfer several hundred dollars to your account, then send you a message saying, “Oops! Can you send that back?” The money that you send goes to the criminal’s personal card.

Here’s where things get sticky for you: When the original victim reaches out to their credit card company about the theft, the bank will reverse the charge, giving them their money back. At that point, the stolen funds will be removed from your account. You’ve lost money, and unlike the victim of credit card theft, you have no way to get it back.

How to avoid it: If you receive an unexpected or random payment, block the user and report the issue to Venmo’s customer service department. You can also request that Venmo cancel the payment. Whatever you do, avoid any direct contact with the sender in case it’s a scam.

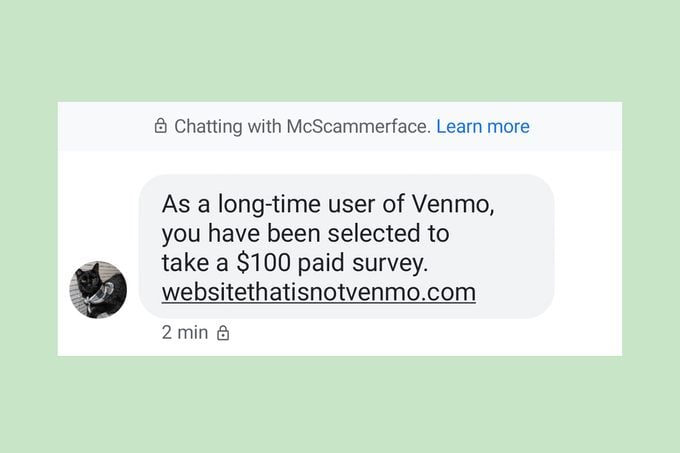

3. Requesting money with a fake link

Beware of unsolicited emails or text messages that look like notifications from Venmo, Velasquez says. In a Venmo text scam, also known as smishing, scammers may con you into clicking a disguised link inside a text message. It might hook you with the promise of free money for taking a quick survey or some other reward.

While the text may appear to come from a legitimate Venmo account, the link will take you to a fake Venmo login page that steals your user data and financial information when you try to log in, according to Gordon.

How to avoid it: Velasquez recommends never clicking on any unknown or suspicious links. Instead, go directly to your Venmo app to log in to your account and confirm that the message is real.

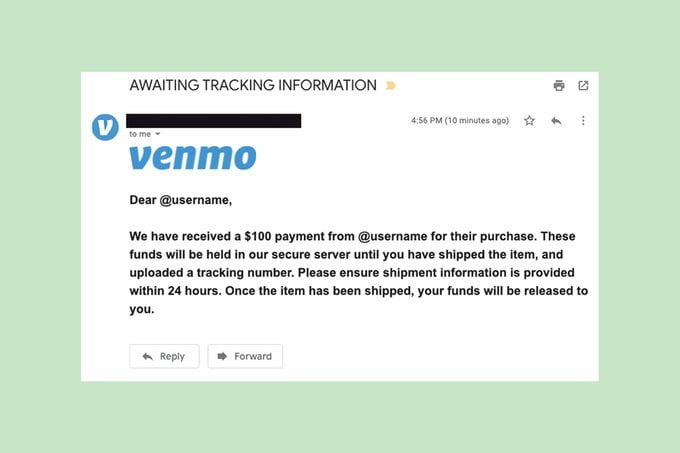

4. Faking payment

When you sell something on Venmo, always verify the person you are selling to. Con artists may ask you to provide the item or service without paying you legitimate funds. To convince you the funds are in your account, they could send you screenshots of fake emails, pay you with stolen credit cards or bank information, or tell you they have sent you a payment that will only reach your Venmo account when you ship the item and upload the shipping information.

How to avoid it: The best way to avoid receiving a fake Venmo payment is to use the app only when exchanging money with people you trust, Velasquez says—especially for those times when you should never use your credit card for payment.

If you do sell something through Facebook Marketplace or another online shopping platform, it’s good practice to exchange the money and the item at the same time and in person, preferably in a well-lit, visible and public location.

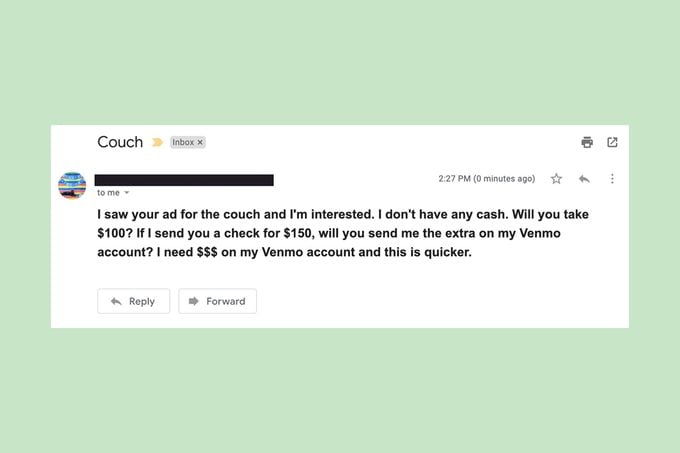

5. Sending a paper check

Another way fraudsters scam victims on online shopping platforms like Facebook Marketplace is by sending a check for more than the value of the item and asking you to send them a payment on Venmo in return. While the check might clear when you cash it, it’ll be rejected shortly after, leaving you in the hole. (Heads up: Many gift card scams have similar tactics.)

How to avoid it: Receiving a message from someone asking you to accept a check in exchange for money on Venmo is a telltale sign of this scam, according to Velasquez. “You should never exchange a check for a payment on Venmo,” she says. Instead, ask to swap the money and the item at the same time and in person.

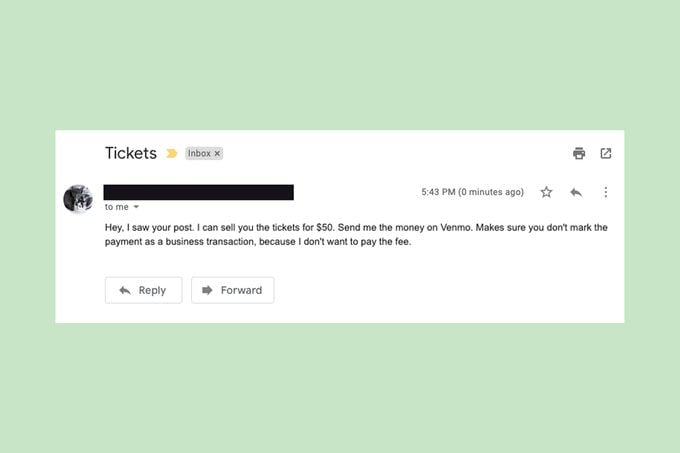

6. Asking for prepayment

Scammers will often list popular or hard-to-find items (like concert tickets or electronics) for sale to lure victims. Once you express interest, they may ask you to pay upfront via Venmo and then never send the item. They may share fake shipping information or screenshots to make it appear as though the item was sent, but in reality, they have already taken off with your money.

How to avoid it: To avoid getting scammed when purchasing items online, keep in mind the old adage: If something seems too good to be true, it probably is. You should also request multiple photos—and even a video—of the item before purchasing.

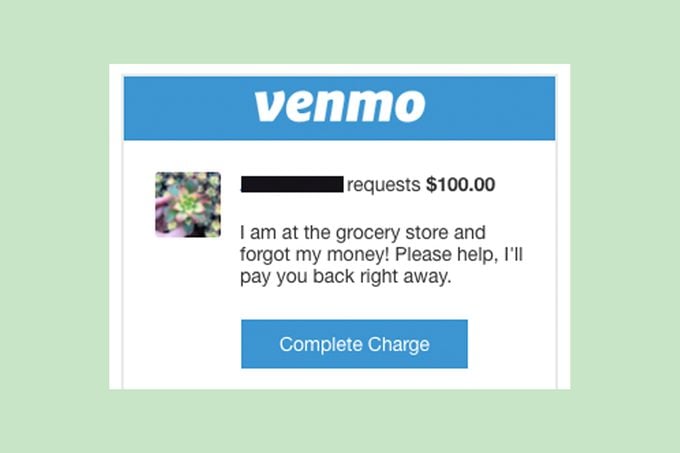

7. Pretending to be your friend and requesting money

Before accepting payment requests from friends, take a close look at their profiles. Some scammers create profiles that impersonate real people—and even go so far as to steal their usernames and profile pictures. With information found on the user’s public feed, these impostors will send requests to individuals who have sent or received money from the user in the past.

How to avoid it: Trust your gut and decline the request if it feels unusual or pushy, Gordon says. If the seller uses high-pressure tactics and a sense of urgency to receive payment in advance, it’s likely a sign that you are dealing with a scammer.

8. Impersonating Venmo support

This popular phone scam hooks its victims by directing them to a fake website, which you may come across when googling “Venmo customer service.” On the site, you’ll find a phony phone number. Call it, and an identity thief will be waiting on the other end of the line, hoping to steal your money or hijack your Venmo account.

The scammer might ask you for your Venmo login information or tell you to pay for the tech services by sending money to another Venmo account.

How to avoid it: If you need to contact Venmo’s customer service or tech support department, the company suggests typing the website into your browser rather than searching for it via a search engine like Google. Or use the “Get Help” feature in the Venmo app, which allows you to contact Venmo directly.

Tech support is always free and will never ask for your login credentials, so don’t agree to pay for anything or share your username and password over the phone, Gordon says. Next, make sure to read about Geek Squad scams and how to avoid falling prey to such online frauds.

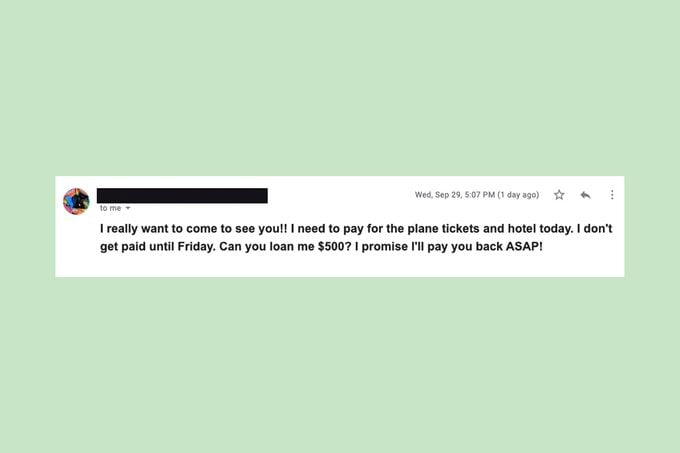

9. Feigning a love match

With tactics like love bombing and catfishing, scammers can win your trust and swindle you out of your money. Most romance scams start out with a fraudster creating a fake profile on a dating or social media site and connecting with the victim. After a few weeks of developing a relationship, the scammer will ask the victim to send them money via Venmo for a made-up emergency.

“The money could be for anything, ranging from a ‘plane ticket’ or ‘hotel room’ to come see you to a loan to help with a business or personal emergency,” Velasquez says.

How to avoid it: Never send money to strangers—your online boyfriend or girlfriend included. “People who are strangers and have no real, verified connection to you are just that: strangers,” Gordon says.

He recommends never loaning money to or sharing your Venmo login information with people you don’t know. Not only are requests for these items a sign of a romance scam, but they could also leave you vulnerable to bank scams and wire fraud.

10. Posing as an employer

Got an exciting new job offer? Before signing any documents, do a little research into the company. Scammers are asking victims to pay upfront via Venmo to onboard or to move someone else’s money using their Venmo account. In other iterations, a job scam looks like a pyramid scheme, in which the user must first send in money or buy products with Venmo to reach their “inevitable fortune.”

How to avoid it: Unfortunately, a job offer that sounds too good to be true probably is, Velasquez says. It’s best to find out what you can about the company through Google, avoid clicking on any offers that seem unrealistic and decline any requests to pay upfront for a new job offer.

11. Pretending to be Venmo

Venmo’s security features make it tough for hackers to access your account, but there’s another way to gain entry: human error. When the multifactor authentication process stops them from signing in to your account, a hacker may call you to access the code Venmo sends to your phone. And they’ll pretend to be a Venmo representative to get the information out of you.

Under the guise of helping you get to the bottom of some fishy transactions they noticed on your account, they’ll ask for you to confirm that you’re the account holder by telling them the code. Of course, the only suspicious thing about your account is what the scammers are currently doing.

In another twist on the scam, fraudsters posing as Venmo agents may ask you to send money to another Venmo account to verify your account. That money, as you may have guessed, goes into their pockets.

How to avoid it: Keep your verification codes private. According to Venmo, company representatives will never ask for a verification code, so if someone does, it’s a sure sign they’re not with Venmo and are probably running a scam. Legit Venmo agents also will never ask you to send money to another account. Those who do make it easier to identify a scammer.

12. Requesting a rental deposit before the lease is signed

Rental scams take many different forms, from fake eviction notices to Venmo scams. In one example, a new landlord might ask you to pay a rental deposit for a property using Venmo before giving you a tour or providing appropriate paperwork (like a lease) and keys. Scammers might also use fake or misleading photos or bait-and-switch rental prices to lure victims in before requesting a deposit.

How to avoid it: If a landlord asks you to pay upfront without showing you the space or providing the lease or keys, it is a red flag, according to Velasquez. Legitimate landlords will allow you to tour the property in person and confirm its availability before filling out an application or transferring money.

What to do if you think you’ve been scammed

If you think you are a victim of Venmo scams, immediately report the incident to Venmo Security Support and cut off contact with the scammer, says Christian Lees, an IT security expert with cybersecurity company Vigilante.

Velasquez suggests alerting the Federal Trade Commission and the Internet Crime Complaint Center if you lost money.

You should also take steps to change your Venmo account password and protect your other digital accounts by choosing a strong, unique passphrase for each. Ditch those easy-to-guess passwords and instead choose passphrases with 12 characters or more; saving your passwords in a password manager makes this much easier. Finally, invest in a secure phone to prevent security problems going forward.

Will Venmo refund your money if scammed?

Here’s the hard truth: Whether you’re a victim of a Venmo email scam, a Venmo phone scam or Venmo credit card scams, you may not get your money back. The company doesn’t guarantee a refund if you have been scammed through its app.

But there are a couple steps you may be able to take to try to get your money back. Through the Venmo Purchase program, buyers can submit a claim and request a refund for certain purchases if they did not receive the item or if the item they received was not as described. To qualify, you need to have made payments with a Venmo Debit Card or sent them to authorized merchants and business profiles.

How to prevent getting scammed on Venmo

The sad fact is that victims of Venmo scams often don’t get their money back. That’s why it’s so important to recognize the signs of these scams and know what to do to avoid falling for one. The steps below are a good place to start.

- Experts recommend protecting yourself against future Venmo scams by keeping your transactions to people you know and trust.

- If you receive an unusual request from someone you know, you can always double-check their profile or reach out to them personally to confirm the request is legitimate, Gordon says.

- Practice good password security by choosing a long, unique passphrase. That means you’ll need to use a different password for each online account.

- Gordon advises against clicking links in text messages or emails sent to you out of the blue. “These links are usually scams,” he says. “If you believe there is an issue with your account, contact Venmo’s customer service—but not via the link in the message.”

With these tips in your back pocket, you’ll be better protected when using the Venmo app. Next, make sure you’re up to speed on the latest PayPal scams—and how to avoid them.

Get Reader’s Digest‘s Read Up newsletter for more tech, humor, cleaning, travel and fun facts all week long.

Sources:

- Eva Velasquez, president and CEO of Identity Theft Resource Center

- Venmo: “Common Scams on Venmo”

- Venmo: “Security”

- Adam Gordon, instructor at ITProTV

- Better Business Bureau: “Scam Alert: This Venmo Scam Sends You Money ‘By Accident'”

- Christian Lees, chief technology officer and chief information officer at Vigilante

- Venmo: “User Agreement”

- Federal Trade Commission: “Report Fraud”

- FBI: “Internet Crime Complaint Center”